Although the major construction machinery markets in the world experienced a recovery growth in 2010, the North American market and the European market still have a large gap from the 2007 peak revenue. The developed market demand will hardly exceed the 2007 peak in the next 2-3 years. China, India, and other Asian regions will become the most active regions for construction machinery consumption in the world in the next few years.

The active local market is often the fastest time for local companies to grow. The 1930-1950S North American market made Caterpillar and Case. The 1960-1970S Japanese market made Komatsu, Hitachi and Kobelco successful. Therefore, the Chinese market in 2000-2020 will inevitably make some of China's first-line brands become world-class companies, and it is also the best time for Chinese companies to catch up with Caterpillar and Komatsu.

China's construction machinery companies are increasingly positioned in the global market to combine with the status quo of the Chinese market. Analysts of China Construction Machinery Business Network believe that Chinese companies have realized the tremendous development opportunities brought about by the global demand for construction machinery. Many first-line brands have begun to seize market share through various means. Newly-entered companies are also eyeing and confidence is rising. China's construction machinery market has entered a period of fierce competition for grabbing money, grabbing share, and grabbing land.

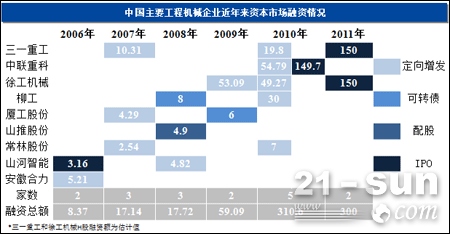

The capital market has become the leading financing method for leading companies. In 2010, Zoomlion successfully raised 15 billion yuan in H-shares; in 2011, Xugong and Sany also entered the stage of H-share financing. According to public information, Xugong and Sany completed the possibility of H-share financing in September and October. Very large.

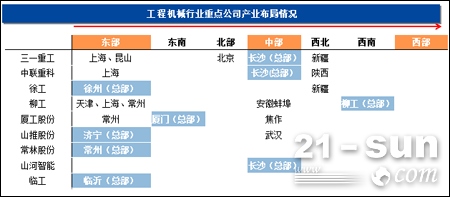

The amount of financing is increasing, and the frequency is getting faster and faster. In addition to increasing investment in headquarters and expanding production capacity, major brands have also made large-scale investments in areas outside the headquarters. At present, the layout of the eastern region has been perfected, and regional competition is fierce. All enterprises have begun to shift to the central region, and Xinjiang has become the preferred area for major companies to invest in the northwest.

The industrial layout has progressed from the eastern coast to the central and western regions. The compound growth rate of China's construction machinery industry was 26.7% from 2005 to 2010. The growth rates of the four leading enterprises including Xugong, Sanyi, Zhonglian and Liugong were all higher than the industry average. According to the association’s forecast, in 2015, the income of China’s construction machinery industry was 900 billion yuan, with an average compound annual growth rate of 17%.

The four companies XCMG, Sanyi, Zoomlion, and Liugong have all set 2015 revenue targets, which are in order of 300 billion, 200 billion, 200 billion, and 50 billion. If all four companies achieve their expected goals, total revenue will be between 6000 and 700 billion yuan, and industry concentration will increase significantly. Even with conservative estimates, the total income of the above-mentioned enterprises in 2015 will be at least 500 billion, and the share will exceed 55%.

Opportunities and risks coexist, and market trends cannot be reversed. For the construction machinery industry, it is now time for real bullets to be picked up. The next 10 years in the Chinese construction machinery industry will inevitably appear like today's great companies such as Carter and Komatsu, but the next 10 years will also be the fiercest competition in the industry. For SMEs, life and death are unpredictable.

In response to market customer needs and industry pain points, Yuzhen Technology has developed a set of "PET bottle appearance defect online inspection program-preform inspection machine, using machine vision technology, replacing manual inspection with machines, which can be completed under non-contact conditions. Quickly and efficiently automatically select and reject each preform, which is the first pass for the appearance quality of the preform.

Equipment parameters

Unit type

YZ-MT18K-2

YZ-MT18K-8

YZ-MT18K-10

Detection function

Deformation, roundness, flash, black dot, dirt, short shot and etc

Detection speed

18000 / hour

Resolution

0.1mm

Power

220V(Optional)/50HZ

Label Vision System,Optical Label Detection,Measure Control Machine,Industrial Vision Machine To Check

Suzhou YUZHEN Automation Technology Co.,Ltd. , https://www.yuzenvision.com

![<?echo $_SERVER['SERVER_NAME'];?>](/template/twentyseventeen/skin/images/header.jpg)